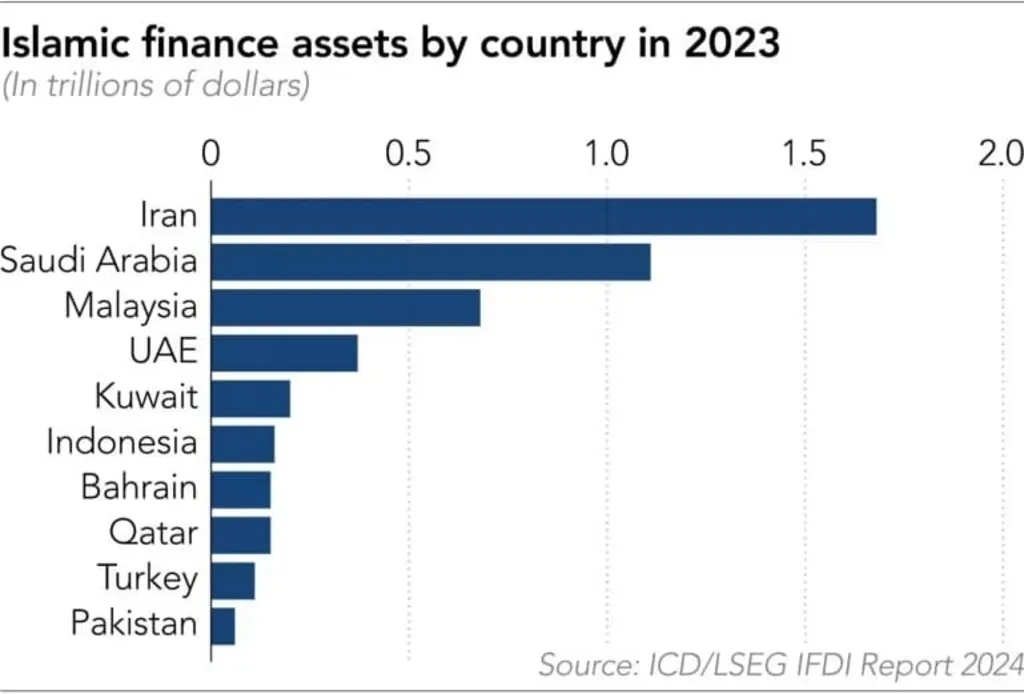

Malaysia has firmly established itself as one of the global leaders in Islamic finance. As of 2023, Islamic finance makes up 38% of the country’s total financial assets. That’s not just a large share, but a reflection of deep Malaysia Islamic Finance Trends integration into the national economy. In other words, the numbers speak volumes.

With USD 620 billion in Islamic finance assets, Malaysia ranks third in the world, contributing roughly 18% of global Islamic finance assets. This scale puts the country ahead of most other Islamic finance hubs.

Domestic Growth Fuels Momentum in Malaysia Islamic Finance Trends

Beyond global rankings, the Malaysia Islamic Finance Trends show strong momentum at home. In 2023, Islamic financing accounted for 41% of total banking loans. Even more telling: over the past five years, Islamic finance contributed 75% of all new loan growth in Malaysia. These figures show that Islamic finance isn’t just big—it’s driving the country’s banking sector forward.

A Shift in Consumer Preference

Malaysians are clearly embracing Shariah-compliant financial products. In 2023, 65% of all new financial accounts opened were Islamic. This reflects not just religious considerations, but growing trust, accessibility, and appeal of Islamic banking options.

People are seeing value in products that align with their beliefs while offering competitive features, especially in a fast-changing financial landscape.

Government Support Powers the Ecosystem

Malaysia’s progress didn’t happen by chance. The government has long recognized Islamic finance as a strategic sector. Policies like the Financial Sector Blueprint 2022–2026 outline clear goals for growth, resilience, and innovation.

These frameworks promote a balanced approach—supporting the market, encouraging inclusion, and ensuring alignment with global financial standards. The result is a system where Islamic finance can thrive alongside conventional banking.

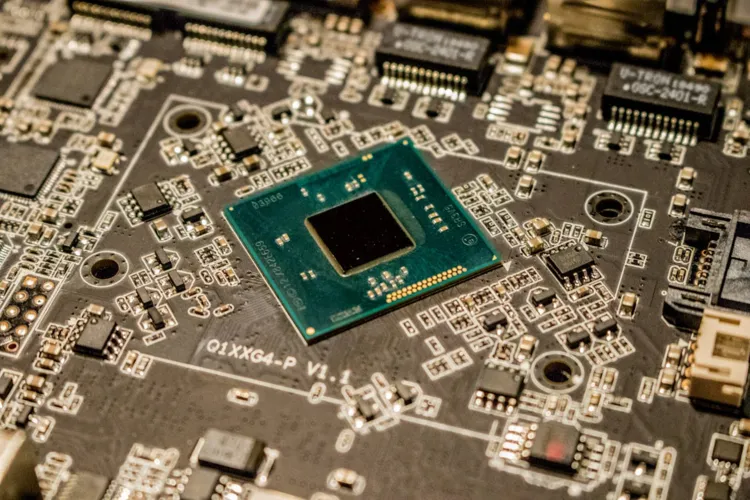

Malaysia Islamic Finance Trends: Tech-Driven Transformation

What sets Malaysia apart now is how it’s blending tradition with technology. The country ranks #1 on the Global Islamic Fintech (GIFT) Index, outperforming 64 other nations. That’s thanks to a vibrant fintech landscape, strong regulation, and forward-looking strategies.

Banks and fintech startups are integrating AI, blockchain, and mobile banking into Islamic finance. These innovations boost efficiency, expand financial inclusion, and improve customer retention.

Digital banking platforms now offer fully Shariah-compliant services, reaching rural and underserved communities. That’s a big step toward broader access and economic participation.

Read Also: Malaysia E-commerce Tech Innovations Are Taking Over

Read Also: Malaysia Digital Economy Growth – Trends and Investment Opportunities

Global Leadership in Multiple Areas

Malaysia doesn’t just lead in banking. It’s also ahead in Sukuk issuance, Takaful (Islamic insurance), and Shariah-compliant investments. In fact, 32.14% of global Islamic banking assets are held in Malaysia.

This leadership spans product categories and global markets. The country’s firms regularly issue high-profile Sukuk and attract international investors seeking ethical and faith-aligned returns.

What’s Next for Malaysia Islamic Finance Trends?

With a growing share of global assets, rising domestic adoption, and a cutting-edge digital strategy, Malaysia is well-positioned for the future. The Malaysia Islamic Finance Trends suggest that the country will continue to shape the global conversation—especially as more consumers and investors look for ethical, sustainable, and tech-enabled financial solutions.