Malaysia’s semiconductor sector is enjoying a breakthrough year. Malaysia Semiconductor Investments secured over RM63 billion (USD 13-15 billion) by March 2025, and the country has reaffirmed its role as a crucial player in the global chip supply chain. Of this, RM58 billion came from foreign investors, a strong vote of confidence in Malaysia’s capabilities.

Malaysia's Global Role in Chips

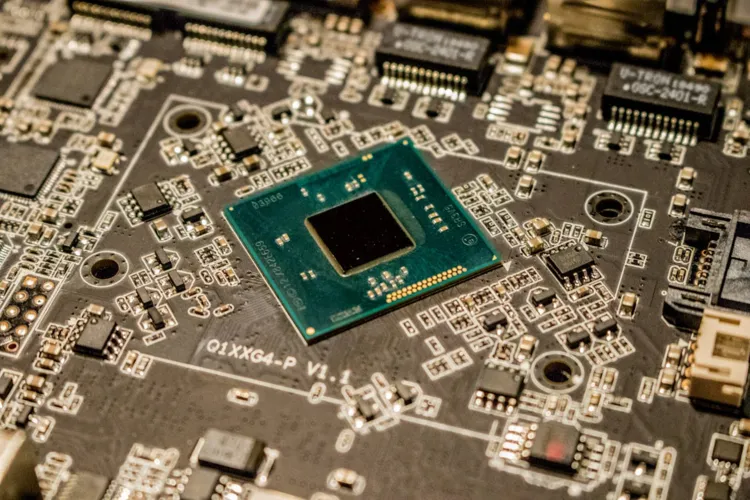

Malaysia is no newcomer to the semiconductor industry. It already accounts for 13% of the world’s semiconductor testing and packaging activities, an essential part of the production chain. Its market share sits at 7% globally, but the government aims to double this to 14% by 2029 through targeted investments in chip design, advanced packaging, and integrated circuit (IC) development.

This ambition is not just about numbers. It reflects Malaysia’s bid to cement its place as a long-term technology hub in Southeast Asia.

Read Also: The Fast Lane of Malaysia Cloud Computing Adoption

Malaysia Semiconductor Investments, Government Support, and Incentives

The Malaysian government has taken bold steps to attract and sustain high-tech investments. The National Semiconductor Strategy (NSS), launched in May 2024, sets a three-phase roadmap backed by RM25 billion (USD 5.3 billion) in fiscal support.

The incentives include tax exemptions, grants, and funding to encourage both foreign and local firms to scale up operations. This has already attracted major players like Infineon, Carsem, NXP, and Plexus, who are investing in advanced packaging facilities, power fabs, and technologies serving fast-growing markets like artificial intelligence and electric vehicles.

Malaysia Semiconductor Investments: FDI Driven by Supply Chain Shifts

A significant driver of Malaysia’s semiconductor growth is its role in the “China Plus One” strategy. With rising geopolitical tensions and risks tied to overreliance on China, global firms are diversifying their supply chains.

Malaysia, alongside Singapore and Vietnam, has emerged as a preferred hub. Companies are moving from a “just in time” approach to a “just in case” supply chain strategy, building resilience against global shocks. This shift has opened the door for Malaysia to capture a bigger slice of semiconductor investments.

Read Also: Malaysia Investment Market Outlook: What’s Hot in 2025?

Export Resilience and Market Reach

Malaysia’s semiconductor exports are a cornerstone of its trade balance. Exports to the United States alone stood at RM56.2 billion in 2024, representing 14.5% of total semiconductor exports. This highlights how deeply Malaysia is integrated into global supply chains supporting advanced industries across North America and beyond.

Such diversification is crucial. By strengthening export ties with the U.S. and other regions, Malaysia reduces its dependence on a single market and builds resilience against future shocks.

Read Also: Unveiling Malaysia Tech Industry Expansion Hotspots

Building the Future of Semiconductors

With over USD 7.5 billion secured in semiconductor investments in 2025, Malaysia is clearly on an upward trajectory. Backed by government incentives, robust foreign investment, and an established role in global testing and packaging, the country is positioning itself for long-term success.

However, achieving its target of 14% global market share by 2029 will require consistent upgrades in talent development, digital infrastructure, and R&D capacity. Policymakers are aware that innovation and skilled labor will be just as important as capital inflows.

Malaysia Semiconductor Investments

As explained above, Malaysia’s semiconductor industry is undergoing rapid transformation, making it one of Southeast Asia’s most promising investment destinations for Malaysia Semiconductor Investments. Its integration into global supply chain diversification strategies, coupled with strong government incentives and rising export strength, significantly contributes to this growth.

With RM63 billion in investments and global players expanding their footprint, the nation is well on its way to becoming not just a regional hub but a global force in semiconductors.