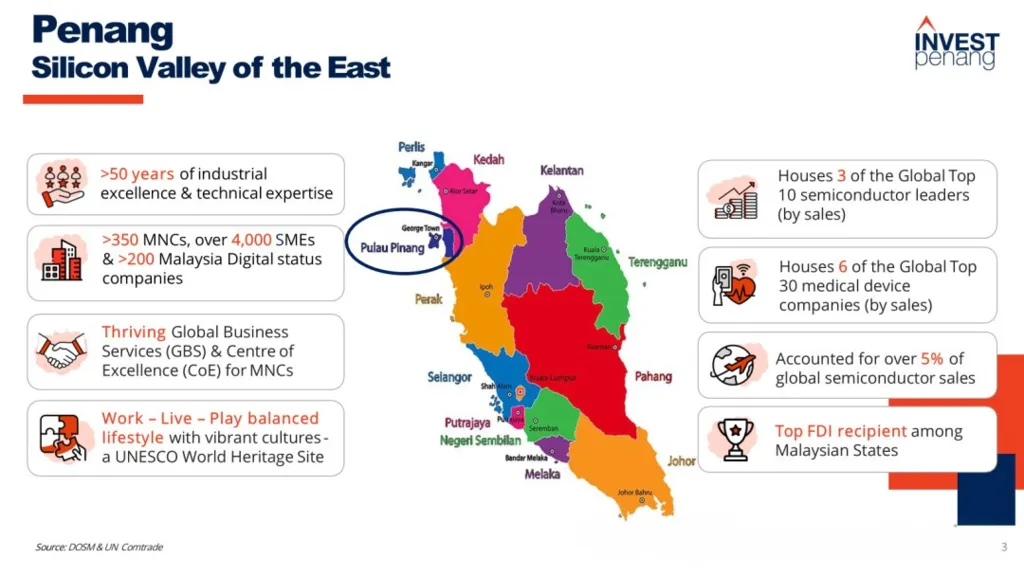

While global headlines focus on advanced chips, the real growth story sits further down the value chain. The Penang semiconductor hub has become one of the world’s most important centers for semiconductor packaging and testing, also known as OSAT. As US-China tensions reshape supply chains, Penang stands out as neutral ground. This position is drawing billions in new investment and pushing the state into the spotlight of the global semiconductor industry.

Why Back-End Manufacturing Matters More Than Ever

Packaging and testing may come after chip fabrication, but without it, no semiconductor can be used. Malaysia leads the global OSAT market, and Penang is its strongest node. The state accounts for about 5% of global semiconductor exports, driven mainly by backend processes.

Penang’s electronics sector recorded 21.8% year-on-year growth heading into 2022. This growth was not driven by cutting-edge chip fabrication, but by deep expertise in packaging, testing, and assembly. As companies diversify away from China, they are choosing proven ecosystems that reduce risk. Penang fits that need.

Penang Semiconductor Hub as Neutral Ground

Geopolitics is now shaping industrial location decisions. The US-China chip war has forced global firms to rethink where they place factories. Penang benefits because it is politically neutral, operationally stable, and deeply integrated into global supply chains.

In 2023 alone, Penang attracted RM60.1 billion in manufacturing foreign direct investment, accounting for 47% of Malaysia’s total FDI. Much of this flowed into the Bayan Lepas Free Industrial Zone, a long-established electronics cluster.

The Penang semiconductor hub is also supported by federal programs, including RM50 million over five years for the Penang Silicon Design @5km+ initiative. This backing reinforces Penang’s role as a safe and scalable base for global firms.

Read Also: Malaysia Semiconductor Industry Expansion: Powering Asia’s Next Tech Frontier

Advanced Packaging Drives the Next Expansion Wave

The next growth phase is being powered by advanced packaging. New technologies like chip stacking are essential for artificial intelligence and high-performance computing. These processes require precision, experience, and existing OSAT infrastructure.

Penang already has these foundations. As demand rises, companies are building new factories rather than retrofitting old ones. This mirrors trends seen in other global hubs, such as Arizona, but with lower risk and stronger backend specialization.

Global semiconductor markets are expected to grow 16% in 2024, with Asia-Pacific at 17.5%. Penang’s strength in advanced packaging positions it to capture a significant share of that growth.

Read Also: Inside the Johor Bahru Tech Hub, The Data Center Powerhouse of Asia

Penang Semiconductor Hub: An Ecosystem Built for Scale

Penang hosts over 350 multinational corporations and 4,000 small and medium enterprises in the semiconductor and electronics sector. It is also Malaysia’s top IC design hub, with more than 30 design companies, the highest in the country.

From 2019 to 2023, the state secured nearly RM20 billion in services investments, adding resilience to its manufacturing base. Looking ahead, Penang’s IC design sector is projected to reach USD84.16 billion by 2030, anchored by OSAT leadership.

Looking Ahead: Strategy for the Penang Semiconductor Hub

This semiconductor hub in Penang is no longer just a manufacturing base. It is a strategic platform where geopolitics, technology, and supply-chain security meet. Companies looking to understand this fast-moving landscape need clear market insight and long-term strategy.

To explore opportunities or navigate investment decisions in the Penang semiconductor hub, connect with Market Research Malaysia by Eurogroup Consulting. With 40 years of distinguished experience, Eurogroup Consulting excels in strategic consulting and market research across Malaysia and Southeast Asia, helping firms succeed in the region’s rapidly evolving semiconductor market.