Malaysia medical device exports 2026 are no longer defined by rubber gloves alone. In 2024, exports surged 31% year over year to RM37 billion, showing strong momentum that now stretches toward advanced medical technology. This growth reflects a clear national shift. Malaysia is moving from volume-based manufacturing to high-value medical devices such as pacemakers, orthopedic implants, and diagnostic systems.

This pivot is not symbolic. It is structural. And it is driven by both global demand and domestic cost pressure.

Beyond Gloves: A Higher-Value Manufacturing Base

Malaysia once dominated global headlines as a glove exporter. Today, its medical device industry looks very different. The country now manufactures complex products including defibrillators, heart valves, stents, hearing implants, endoscopes, and in-vitro diagnostics.

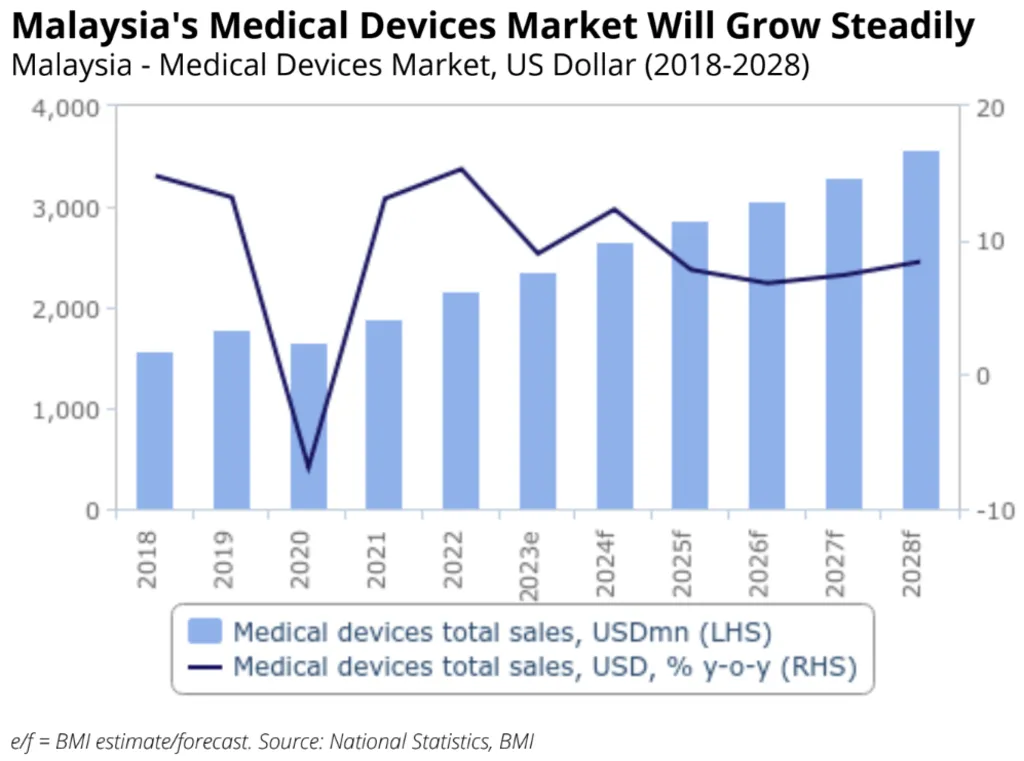

More than 200 manufacturers operate across electro-medical, therapeutic, and monitoring segments. Local firms like Abio Orthopaedics produce implants alongside global multinationals. Malaysia medical device exports 2026 market is shifting fast toward higher-value products, growing at 9.5% CAGR toward $4.5 billion by 2028.

This evolution supports export strength. Medical device exports reached $6.37 billion in 2023 and $6.15 billion in the first nine months of 2024, up 30% year over year. Forecasts under NIMP 2030 support continued expansion into 2026.

Read Also: Malaysia Trade & Export Slowdown Masks Domestic Gains

Malaysia Medical Device Exports 2026 and the Penang Cluster

Penang sits at the center of this transformation. The state attracted RM3.6 billion in medical technology investments, positioning itself as a regional hub for regulated, high-precision devices.

Read Also: Malaysia Medical Tourism Market Soars with Healthy Promise

US firms are leading this wave. Boston Scientific expanded its Penang presence with a 110,000-square-foot global distribution center, its first in Asia. The facility supports worldwide supply chains and created 300 jobs.

Dexcom went further. The US-based company announced a $670 million investment to build manufacturing operations in Penang, creating 3,000 jobs. Today, more than 30 multinational MedTech firms operate in the state, reinforcing Malaysia’s role in global device supply chains.

Why High-Value Devices Offset Rising Labor Costs

Rising labor costs are a reality across Southeast Asia. Malaysia can no longer compete on low wages alone. The solution is high-value manufacturing.

Under NIMP 2030, Malaysia promotes automation, Industry 4.0, and advanced manufacturing. Between 2019 and 2023, the sector attracted RM24.7 billion in investments, with foreign inflows peaking at RM4.5 billion in 2022.

Producing pacemakers and diagnostics requires fewer workers but higher skills. This shift creates 130,000 high-skilled jobs and contributes RM1.8 billion annually to GDP. Automation incentives and R&D tax breaks help companies stay competitive, even as labor costs rise above peers like Vietnam or Indonesia.

Looking Ahead for Malaysia Medical Device Exports 2026

Malaysia's medical device exports in 2026 reflect a mature industrial strategy. High-tech manufacturing is no longer optional. It is the only sustainable path forward.

For companies seeking deep insight into this evolving landscape, Market Research Malaysia by Eurogroup Consulting offers strategic support grounded in 40 years of distinguished experience. With a strong focus on market research in Malaysia and the ASEAN region, Eurogroup Consulting helps investors understand risks, identify opportunities, and succeed in fast-changing markets tied to Malaysia medical device exports 2026.