Malaysia’s startup scene is waking up again. After years of steady groundwork, the country is now seeing a strong rise in venture capital activity, a true Malaysian venture capital resurgence. Let's take a closer look!

A Market on the Move

Malaysia’s private equity market reached USD 3.3 billion in 2024 and is set to grow at a CAGR of 8.7% through 2033. Much of this comes from smarter regulations and more institutional investors stepping in.

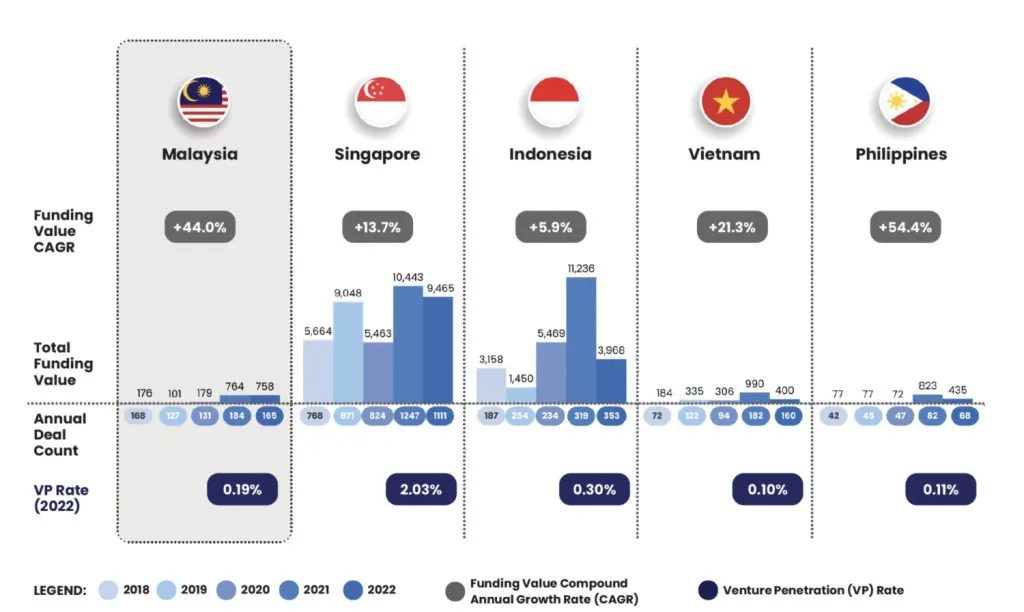

Between 2018 and 2022, total VC funding in Malaysia grew at an impressive 44% CAGR, one of the fastest rates in Southeast Asia. That kind of growth doesn’t happen by accident. The government’s ongoing reforms and tax-friendly policies are fueling a new wave of investment confidence.

Government Support Sparks New Energy

In June 2025, Malaysia introduced powerful venture capital tax incentives — a 5% tax rate for up to 10 years for funds investing at least 20% of their capital in local startups. The move is designed to draw both domestic and foreign players deeper into the ecosystem.

It’s already working. Foreign digital investments hit MYR 29.47 billion (USD 6.19 billion) in Q2 2025, more than double the amount from the previous quarter. In total, Malaysia recorded RM190.3 billion (USD 45 billion) in approved investments in the first half of 2025 — an 18.7% year-on-year increase. That’s not just growth. That’s confidence.

Read Also: Malaysia VC Surge Sees Fresh Deals, Brings Hope to Startup Founders

Fintech Takes the Lead in Malaysian Venture Capital Resurgence

Nowhere is this renewed energy clearer than in fintech. Malaysia is home to over 300 fintech companies, and they’re thriving thanks to strong government support, active institutional investors, and frequent equity rounds.

From digital payments to alternative lending and wealth tech, fintech startups are reshaping how Malaysians handle money. Investors are betting big on this sector as it continues to expand across the region. With high adoption rates and clear regulation, Malaysia’s fintech space is setting the pace.

Read Also: Malaysia VC Firm Granite Asia Sparks New Innovation Wave in 2025

Malaysian Venture Capital Resurgence: Climate Tech Gains Ground

Fintech isn’t the only star. Climate tech is quickly becoming another magnet for capital. Malaysia’s pension fund KWAP launched Dana Iklim+, a climate fund with an initial RM2 billion (USD 475 million) commitment. Its goal: to finance climate-related innovation and support Malaysia’s net-zero by 2050 vision.

The momentum is backed by investors themselves, with 40% of Malaysian investors now having targets or systems to track climate-related finance. This shift shows that sustainability isn’t just a buzzword anymore; it’s becoming a central part of Malaysia’s investment future.

Ecosystem Building in Action

The Malaysia Digital Economy Corporation (MDEC) has also played a major role, facilitating 262 funding deals worth USD 402 million from 2020 to 2023. These efforts have built a solid base for Malaysia’s digital transformation and VC ecosystem.

The combination of policy, innovation, and investor enthusiasm is transforming Malaysia into a regional hub where startups don’t just start — they scale.

Looking Ahead: Malaysian Venture Capital Resurgence

With fintech leading innovation and climate tech gaining momentum, Malaysia’s venture capital resurgence is reshaping its startup landscape. Investors, founders, and policymakers are now aligned toward a single goal, which is sustainable, technology-driven growth.

For businesses and investors ready to explore this momentum, Market Research Malaysia can help you navigate opportunities in Malaysia’s fast-evolving VC scene. Contact our team to learn how to turn this Malaysian venture capital resurgence into your next strategic advantage.