Malaysia is seeing a powerful upswing in venture capital (VC) activity, driven by record-breaking foreign digital investments and growing investor confidence. The latest numbers confirm what many in the industry have felt for months: the Malaysia VC Surge is real and accelerating fast.

Massive Growth in Digital Investments

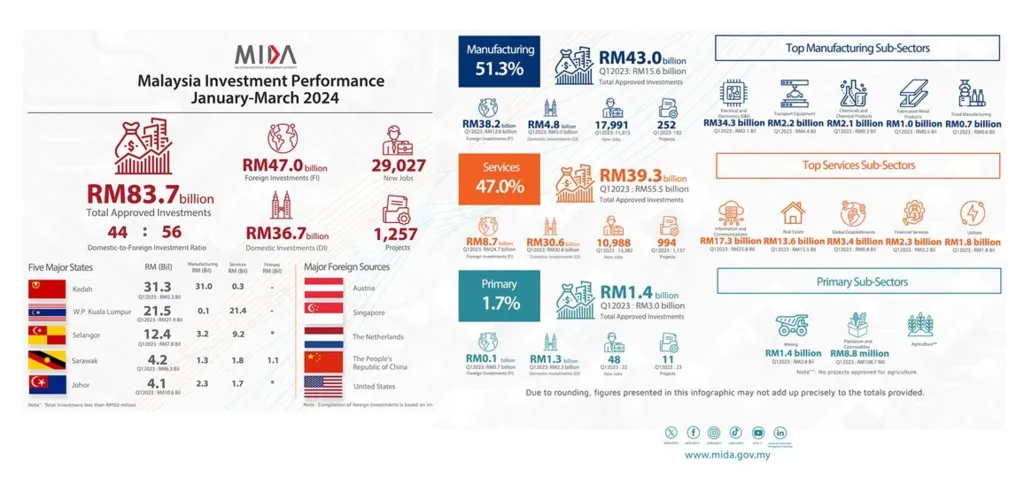

In the second quarter of 2025 alone, Malaysia attracted MYR 29.47 billion (US$ 6.19 billion) in foreign digital investments. That’s more than double the MYR 13.11 billion (US$ 2.75 billion) recorded in the first quarter. This sharp jump highlights how global investors are increasingly betting on Malaysia’s digital economy.

Overall, Malaysia recorded RM190.3 billion (US$ 45.0 billion) in approved investments during the first half of 2025. This marks an 18.7% increase year-on-year, showing that the country’s investment environment is both stable and expanding.

Malaysia VC Surge: The Country's Rising Status as a Regional VC Hub

Behind these strong figures is a long-term national plan. The Malaysia Venture Capital Roadmap 2024–2030 aims to position the country as a regional hub for venture capital. Between 2018 and 2022, total VC funding in Malaysia grew at a compound annual growth rate (CAGR) of 44% — one of the fastest in Southeast Asia.

Read Also: Malaysia VC Firm Granite Asia Sparks New Innovation Wave in 2025

Government agencies, institutional investors, and private funds are now working together to attract both local and international capital. This cooperation is helping startups scale faster while building Malaysia’s image as a serious destination for innovation-led investments.

Fintech Leads the Charge in Malaysia VC Surge

The fintech sector continues to be Malaysia’s most dynamic startup vertical. The country is home to over 300 fintech companies, benefiting from strong government support, widespread digital adoption, and active institutional backing.

While some regional markets faced a fintech funding slowdown in 2024, Malaysia stood out in 2025 with robust equity funding rounds. Investors remain confident in local startups working on payment solutions, digital banking, and financial inclusion.

This steady deal flow shows that Malaysia’s fintech ecosystem has matured. With favorable regulation and growing consumer trust, investors see less risk and more long-term value in Malaysia’s digital finance space.

Read Also: Malaysia Islamic Finance Revival Reinforces Islamic Finance Momentum

Climate Tech Emerges as a New Investment Magnet

Another bright spot in the Malaysia VC Surge is climate tech. More venture funds are channeling capital into companies tackling sustainability and green innovation.

Notable VC players like VentureTECH, Quest Ventures, and Indelible Ventures have made climate tech a core investment focus. VentureTECH alone has completed multiple deals in this space, reflecting strong institutional interest in environmental and impact-driven technologies.

This growing climate tech ecosystem complements Malaysia’s push for a low-carbon economy. Startups developing renewable energy solutions, carbon tracking systems, and circular economy platforms are now drawing both local and foreign funding attention.

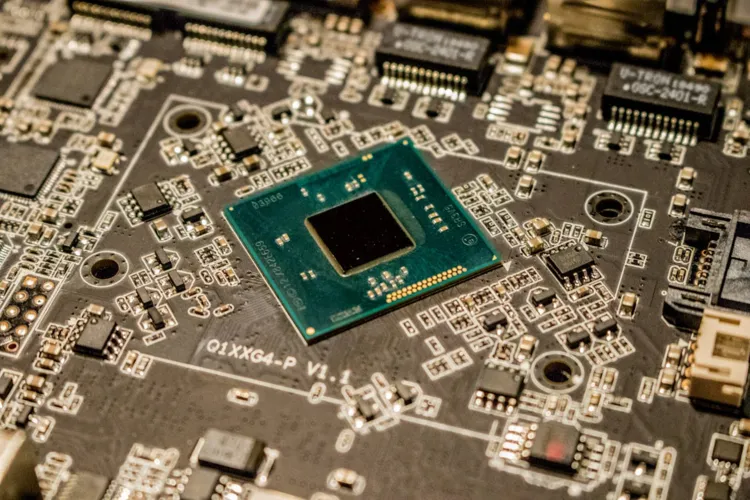

Tech and IoT Add Depth to the Investment Landscape

The first half of 2025 also saw capital flowing heavily into Internet of Things (IoT) and e-commerce startups. These sectors are benefiting from Malaysia’s digital infrastructure expansion and high internet penetration. Together with fintech and climate tech, they form the backbone of Malaysia’s emerging innovation economy.

Institutional Support Strengthens the Ecosystem

Institutions like Khazanah Nasional have been instrumental in building investor confidence. Through initiatives such as Dana Impak, Khazanah is backing ventures that balance commercial value with social impact. Partnerships with global VC firms are also deepening, giving local startups better access to international capital networks and expertise.

This growing institutional engagement ensures that the current investment momentum is not just a temporary spike but part of a sustainable growth cycle.

Malaysia VC Surge Outlook: From Momentum to Leadership

With strong numbers, strategic policies, and a maturing startup base, Malaysia is now positioned as one of Southeast Asia’s fastest-growing venture capital markets.

The Malaysia VC Surge isn’t just about short-term gains. It signals a broader economic transformation, one where innovation, sustainability, and financial technology are becoming key pillars of national growth.