Malaysia Islamic Finance Revival is entering a new phase of expansion. By the end of 2024, Islamic financing made up 43% of total banking system loans, showing steady and consistent growth. With an expected 8% expansion rate in 2025, it is set to outpace conventional banking loan growth, which stood at 3.7% in 2024.

This momentum reinforces Malaysia’s position as a global leader in Islamic finance. The country ranks first in the Islamic Finance Development Indicator (IFDI) among 15 countries, with a maturity score of 103 in 2023. By the end of 2024, Islamic banking assets had surpassed USD 260 billion, highlighting the strength of its financial ecosystem.

Policy and Funding Support Driving Momentum

The Malaysian government is backing the sector with targeted policies and funding. In 2025, MYR 100 million (USD 21–22 million) was allocated to encourage innovation in Islamic financing, especially in climate finance and food security projects.

Bank Negara Malaysia’s revised policies, effective January 2025, require Islamic banking windows to meet higher prudential and capital requirements. These reforms aim to enhance resilience and ensure Islamic finance can grow independently without depending on conventional frameworks.

In addition, RM 10 million has been set aside for academic research on Islamic economics. This will deepen understanding of Shariah-based principles and promote inclusive and sustainable economic growth.

Value-Based Innovation at the Core of Malaysia Islamic Finance Revival

Malaysia’s Financial Sector Blueprint 2022–2026 places strong emphasis on value-based finance (VBF), which integrates financial returns with positive social and environmental outcomes. This approach aligns closely with Shariah principles and positions Islamic finance as a key driver of inclusive growth.

Since the introduction of Value-Based Intermediation (VBI) in 2017, Malaysian Islamic banks have disbursed over MYR 94.2 billion (USD 20.9 billion) to support renewable energy and other green projects. Notably, MYR 8.8 billion (USD 1.95 billion) has funded over 4,500 green initiatives, ranging from solar farms to energy-efficient infrastructure.

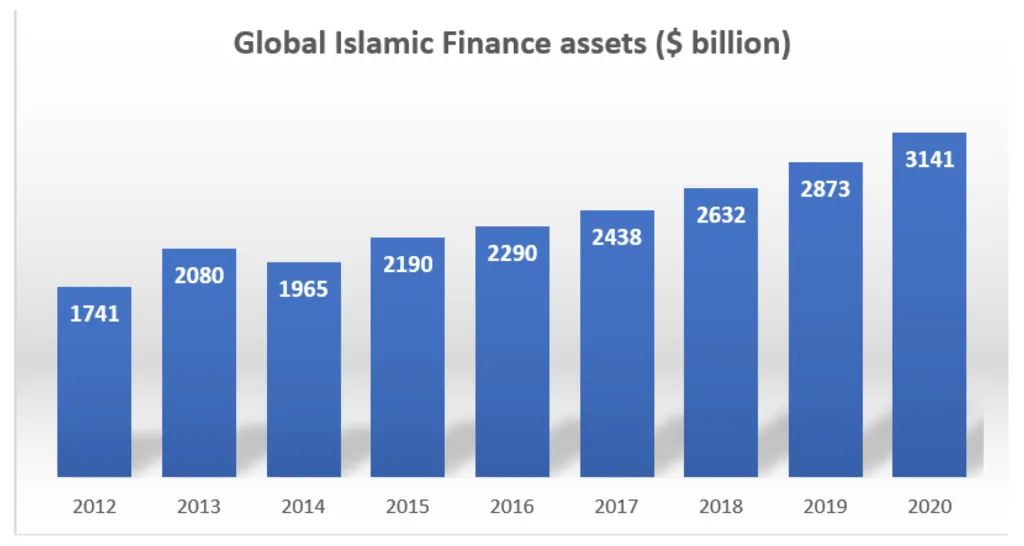

Global Context Strengthening Malaysia’s Role

The Islamic Financial Services Board’s 2025 report confirms that global Islamic finance is expanding rapidly, with total assets reaching USD 3.88 trillion in 2024—a 14.9% year-on-year increase. This growth shows rising market participation across the world.

Malaysia’s leadership in this global trend is clear. Its combination of high market maturity, strong asset base, and government-backed innovation makes it a model for other countries seeking to strengthen value-based financial systems.

Read Also: The Emotional Global Pull of Malaysia Islamic Finance Trends

Malaysia Islamic Finance Revival: Sustainability as a Growth Engine

Islamic finance is uniquely positioned to lead in sustainable investing. Its principles already prohibit harmful industries and encourage ethical investment, making it well-suited for projects that address environmental and social challenges.

By linking climate finance, food security, and inclusive growth to Islamic banking products, Malaysia is setting a precedent for other emerging markets. This creates opportunities not only for financial institutions but also for investors, startups, and communities that benefit from socially responsible capital.

Malaysia Islamic Finance Revival: Looking Ahead

With steady market expansion, strong government backing, and proven value-based innovation, Malaysia’s Islamic finance revival is set to continue gaining global attention. The focus on sustainability, digital transformation, and inclusive growth will likely attract more international investment and partnerships in the coming years.

How We Can Help Your Business

As a business consulting firm with over 40 years of experience, Market Research Malaysia helps companies navigate high-growth sectors like Islamic finance. Our services span from Market Research to Consumer Behavior Analysis. Whether you’re looking to enter the Islamic finance market or expand your presence, our expertise ensures your strategy is data-driven and competitive.